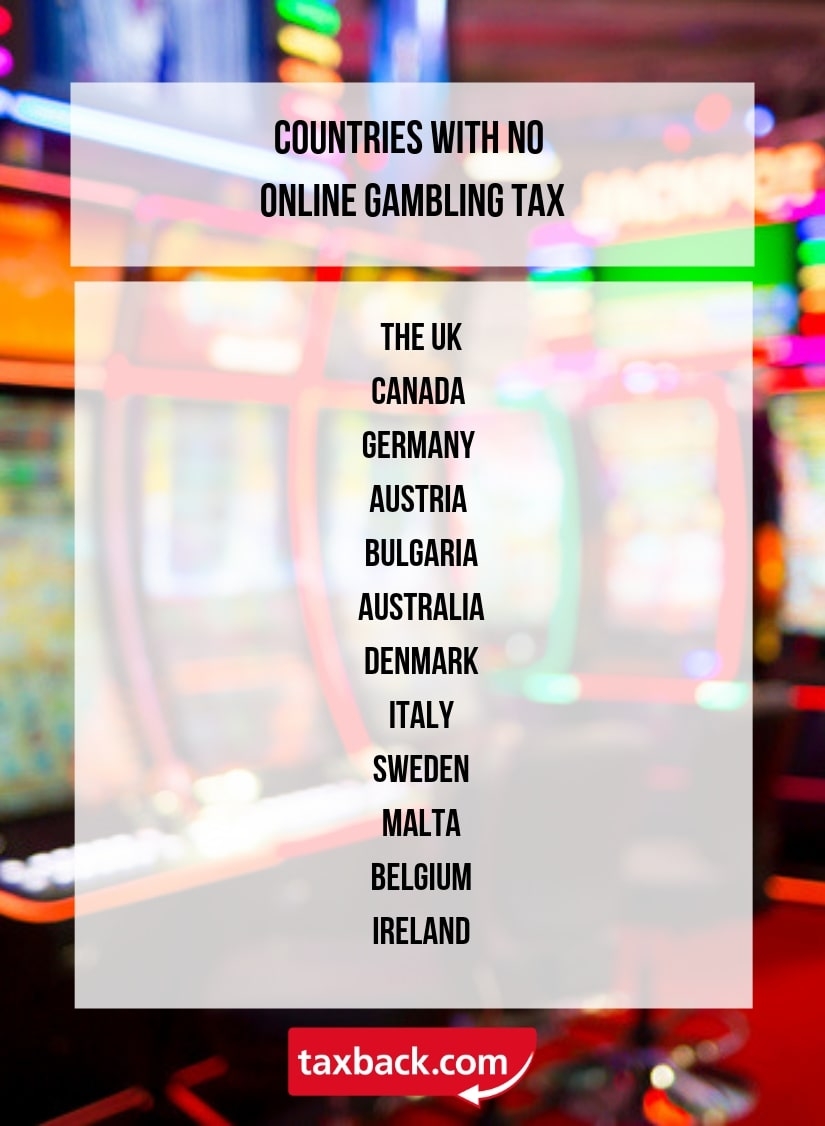

Online Gambling Tax Ireland

In the Irish 2011 Budget (7th Dec 2010) – it was announced that Ireland will be applying Betting Duty to Offshore Betting (Online or Telephone )

The Casino Regulation Committee was set up in August 2006 and its report was published in July 2008 under the title Regulating Gaming In Ireland (PDF - 2.11MB) Review of Gambling A paper entitled Options for Regulating Gambling published in December, 2010, represented the culmination of a public consultation undertaken by the Department as part. Under the new regulations set out in the Act, online casino, gaming and bingo services in Ireland will face a 1% tax on gross gaming revenue. Online sports betting operations will be charged at a 15% net revenue rate, the same rate set by the UK Gambling Commission for activities in the UK market.

Betting Duty is currently 1% and only applies to bets placed in betting shops.

Online Gambling Tax Ireland 2020

The Irish Government now intends to include provisions in the Finance Bill and revise the Betting Act 1931 to ensure that all bookmakers taking bets from Iris customers will pay 1% betting duty

Betting Exchanges will also be subject to a tax under the new arrangements but the calculation of the tax will differ from that applying to bookmakers.

Online Gambling Tax Ireland Uk

The Government expect to get as much as €20 million a year from this tax.

Online Gambling Tax Ireland 2019

In Italy – they recently introduced a similar tax on business with Italian customers at between 2% and 5%. The UK is also looking at bringing in similar taxes.